Recently, the Big Three of cloud computing – Amazon, Microsoft, and Google, also known as AMG – announced their quarterly results. Their quarter could be summarized using the beginning words of Dickens’ A Tale of Two Cities: “It was the best of times, it was the worst of times.”

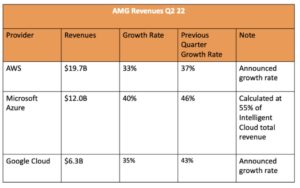

Each of the providers showed strong revenue growth (see below), with numbers that most businesses would envy – so, the best of times. On the other hand, those growth numbers are down from the previous quarter – so, the worst of times?

Also see: Top Cloud Companies

One might ask the question, why did the quarterly growth rate slow, and what – if anything – does it imply about AMG’s future prospects? And what does it mean for ongoing cloud adoption by big enterprises, whose spend represents a preponderance of total IT spend?

One obvious factor that all of the providers noted in their results discussions is that the strengthening dollar caused revenues earned in non-dollar markets to shrink due to exchange rates. Satya Nadella stated that exchange rate issues caused a drop in overall revenue of $595 million. So a small amount of the reduced growth rate can be attributed to macroeconomic factors external to AMG.

Quarterly growth rates for the top cloud vendors continue their rapid upward pace.

Cloud Adoption: Pedal to the Metal

What about the rest of the growth rate drop? Are enterprises slowing their cloud adoption, impairing future AMG growth rates?

From my perspective, there is no evidence of enterprises reducing their cloud adoption plans. In fact, I believe that, if anything, enterprises are increasing the scale of the future AMG adoption. Nadella reinforced this by saying “We are seeing larger and longer-term commitments and a record number of $100 million-plus and $1 billion-plus deals this quarter.”

One would guess that the A and G parts of AMG would also be seeing the same kind of adoption commitments.

This scale of commitment reflects the changing nature of cloud adoption – it’s moved from individual applications or even a class of digital transformation applications. At this scale of spend, enterprises are moving large percentages of their total application portfolio to the cloud, often as a result of data center downsizing or evacuation.

Consequently, it’s unlikely that AMG is seeing a drop in enterprise demand. As Nadella’s quote indicates, if anything, enterprise demand is growing.

Also see: Cloud Native Winners and Losers

Slippery Road Ahead

Notwithstanding the increased enterprise appetite to put larger application portfolios in the cloud, it’s clear that AMG growth rates did drop during the quarter. What could account for this reduction, given that enterprises aspire to move more to AMG?

I believe that enterprises are encountering practical challenges to their desire to accelerate cloud adoption, and these challenges reflect real-world issues that often stand in the way of enterprise cloud aspirations.

First, there are budget issues – investment has to be made in application migration while those same applications have to be kept up and running even as the migration activities proceed. Each company can only afford to ‘double spend’ on a part of its application portfolio, which results in longer migration roadmaps.

Second, most companies find the process of application migration more complex than initially assumed. The very term ‘lift and shift’ seems to promise low effort in moving an application to the cloud, but the term elides the totality of tasks required to move an application to the cloud, even one for which no significant code or architecture changes are envisioned.

To name just a few, there are all the core services that need to be in place for an application to operate in a cloud environment: identity management, security enforcement for items like intrusion detection, data migration and/or implementation of a different database or storage.

Imagine this list blown out to an action item list of 15 or 20 separate actions, each of which must be assessed and implemented for each migrated application, and one can easily understand why lift and shift, as alluring as it sounds, ends up being more work than first imagined.

The practical result of this slippery road is that application deployment timelines begin to run longer than first planned, with a knock-on effect slowing down overall portfolio migration roadmaps.

What this implies for AMG growth rates is not a permanent reduction, but a pushing out of planned adoption to later quarters, with the potential of extending or even increasing out-period growth rates.

Also see: Best Machine Learning Platforms

Still Pretty Good Times

So, to return to the Dickens quote, are these the best of times…or the worst of times?

Pundits in the technology and financial industries are quick to pounce on any shortfall to predicted financial results to proclaim earth-shattering effects. According to them, reduced AMG growth rates means dark times ahead for the hyperscalers with additional scary monsters lurking due to interest rates increases, enterprises confronting a recession, and, no doubt, the cancelation of favorite streaming video shows.

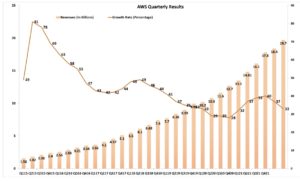

One has only to look at the chart below, which outlines Amazon’s cloud revenues and growth rates since 2015, to see that AWS has been on a multi-year tear. Its revenue growth rate has bounced around, but the overall revenue levels have continued to exhibit an ‘up and to the right’ movement.

For a business of its size, AWS is enjoying a remarkable growth rate.

Microsoft and Google are achieving the same kind of enviable results, albeit on somewhat smaller revenues. Just as a single swallow does not a summer make, so too does a single quarter not an unbreakable trend make.

Amazon Web Services is now a $80B+ business growing at over a third year over year. Frankly, many companies would gratefully accept this kind of growth rate on smaller revenue streams, and most companies have resigned themselves to far lower growth rates on vastly lower revenue numbers.

The more important lesson to take away from this quarter is that the direction of cloud adoption is clear, even if the curve slope is a bit indeterminate. The challenges hindering adoption are clear and must be addressed, but they are not permanent nor insurmountable.