AI finance tools are software that leverages AI to handle an array of tasks involving money, including overall management, offering insights and making predictions.

AI finance tools have seen a surge in interest and investment since the explosion of generative artificial intelligence (AI) created by the debut of ChatGPT. In 2024, we are witnessing the continued rapid growth both in the number of AI finance tools and the tasks they can perform.

In this AI finance software review, we’ll examine the top-rated AI finance tools, as well as what/who they are best for, their pros and cons, features, and pricing to help you discover the best solution for your business.

See our top picks for the 11 best AI finance software.

- Sage Intacct: Best for small and medium-sized enterprises

- Oracle Netsuite: Best all-in-one finance management software

- Intuit QuickBooks: Best for small business accounting

- Zoho Finance Plus: Best for service-based businesses

- Domo: Best for business intelligence and analytics

- Booke.AI: Best for bookkeeping automation

- Stampli: Best for accounts payable teams

- Nanonets: Best for automated data capture

- Planful: Best for financial planning and analysis

- Trullion: Best for companies with complex financial transactions

- Vena: Best for real-time intelligent reporting and analysis

TABLE OF CONTENTS

Top AI Finance Software Comparison

See how the best artificial intelligence finance software stack up against each other in terms of feature and pricing.

| Best for | Free Trial | Starting Price | Top features | |

| Sage Intacct | Small and medium-sized enterprises | 30-day free trial | $58.92 per user per month |

|

| Oracle Netsuite | All-in-one finance management software | 14-day free trial | Available upon request |

|

| Intuit QuickBooks | Small business accounting | 30-day free trial | $15 per month |

|

| Zoho Finance Plus | Service-based businesses | 14-day free trial | $249 per organization per month |

|

| Domo | Business intelligence and analytics | Trial available upon request | $300 per month |

|

| Booke.AI | Bookkeeping automation | Trial available upon request | $20 per business per month |

|

| Stampli | Accounts payable teams | N/A | Available upon request |

|

| Nanonets | Automated data capture | 7-day free trial | $0.3 per page |

|

| Planful | Financial planning and analysis | Trial available upon request | Available upon request |

|

| Trullion | Companies with complex financial transactions | N/A | Available upon request |

|

| Vena | Real-time intelligent reporting and analysis | N/A | Available upon request |

|

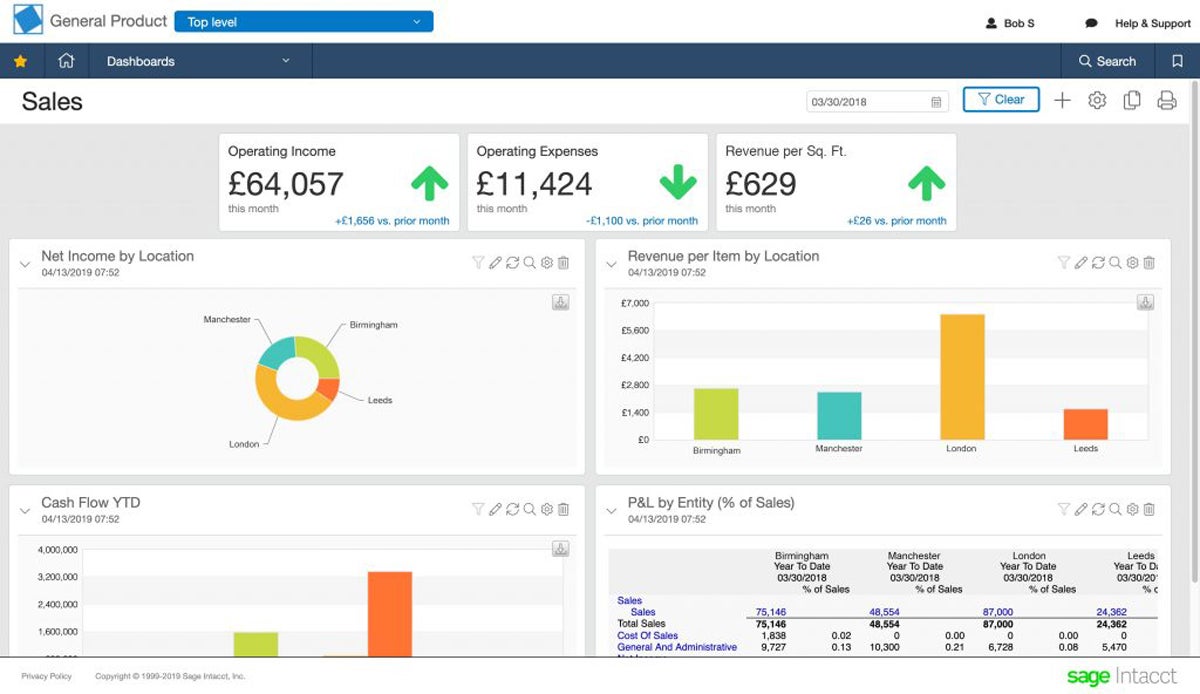

Sage Intacct: Best for Small and Medium-sized Enterprises

Overall rating: 3.7

- Pricing: 4.2

- Feature Set: 4.4

- Ease of Use: 2

- Support: 4

Sage Intacct is an AI-based finance management software that provides companies with real-time data and analytics to streamline and automate financial processes. It is specifically designed for small to medium-sized businesses and helps them manage their accounting, cash flow, budgeting, and other financial functions.

It offers core accounting functions such as general ledger, accounts payable, accounts receivable, and cash management, as well as advanced features like real-time reporting, project accounting, revenue recognition, and global consolidations.

Sage Intacct integrates with other business applications and offers customizable dashboards and reports to help businesses make informed decisions and drive growth.

Pros and Cons

| Pros | Cons |

|---|---|

| Highly customizable | Received below-average eWeek rating for ease of use |

| Easy to implement user interface | Long wait time to download reports |

Pricing

Sage doesn’t advertise the rates of its Intacct product. The company requires the potential buyer to contact their sales team for a quote. See the pricing of Sage 50 below.

- Pro Accounting: $58.92 per user per month or $595 per user/year. Limited to one user.

- Premium Accounting: $96.58 per user per month or $970 per user/year. Ranges from 1 to 5 users.

- Quantum Accounting: $160 per user per month or $1,610 per user/year. Ranges from 1 to 40 users.

- Pro Accounting with Payroll: $993 per year. For 1 to 10 employees.

- Premium Accounting with Payroll: $1,368 per year. For 1 user plus payroll for 1 to 10 employees.

- Quantum Accounting with Payroll: Custom quote.

Features

- AI-charged general ledger.

- Dashboards and reporting.

- Accounts payable and accounts receivable automation.

- Advanced budgeting tools.

- Automated bank reconciliation.

- Reporting (Financial Statements, Cash Flow, GL).

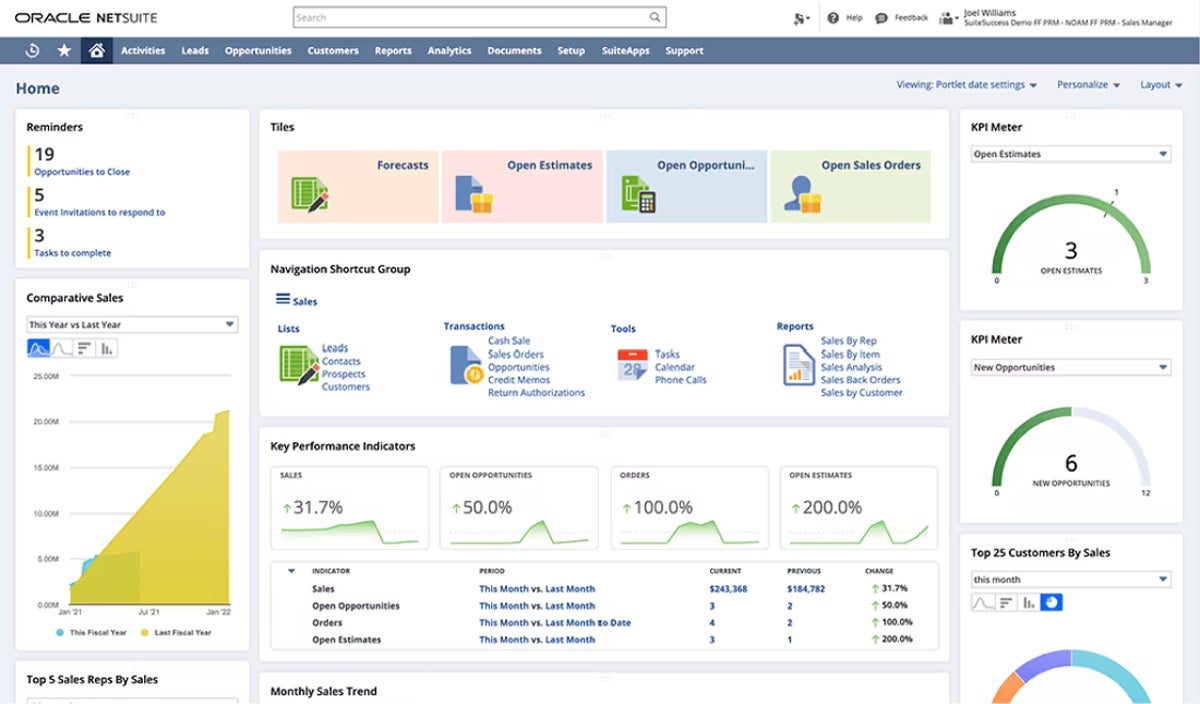

Oracle NetSuite: Best All-in-One Finance Management Software

Overall Rating: 3.1

- Pricing: 1

- Feature Set: 5

- Ease of Use: 2

- Support: 4

Oracle Netsuite provides businesses with tools for enterprise resource planning (ERP), financial management, customer relationship management (CRM), and e-commerce. NetSuite Cloud Accounting software is a component of the larger Netsuite platform that specifically focuses on financial management and accounting functions. It offers features such as general ledger, accounts payable and accounts receivable, budgeting and forecasting, financial reporting and analytics, cash flow management, and revenue recognition.

With its integrated modules for ERP, CRM, and e-commerce, NetSuite provides a unified platform for managing all aspects of a company’s finances, helping businesses improve productivity, accuracy, and profitability. The company serves businesses across 21 industries and is capable of handling complex financial processes.

In October 2023, the company launched its generative AI tool, NetSuite Text Enhance, which helps users create and refine personalized and contextual content using AI technology. This tool can be particularly beneficial for finance and accounting teams to expedite collections, close books faster, and focus on more strategic tasks.

Pros and Cons

| Pros | Cons |

|---|---|

| Easy to integrate with other systems if your existing Netsuite environment is well set up | Lacks pricing transparency |

| It can be customized per your business needs | Not easy to use |

Pricing

Contact the company for a custom quote.

Features

- Accounts receivable and payable.

- Account reconciliation.

- Cash management.

- Close management.

- Fixed assets management.

- General ledger.

- Payment management.

- Tax management.

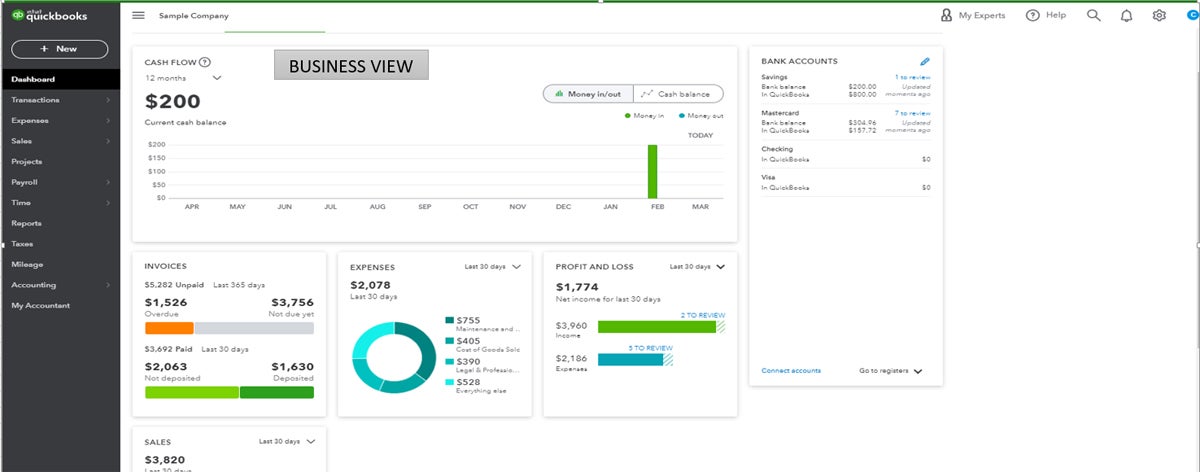

Intuit QuickBooks: Best for Small Business Accounting

Overall Rating: 3.9

- Pricing: 4.2

- Feature Set: 4.2

- Ease of Use: 3.5

- Support: 4

With features like invoicing, expense tracking, financial reporting, and more, Intuit QuickBooks is an accounting software businesses use to manage their finances, track expenses, create invoices, and generate reports. QuickBooks streamlines accounting for small businesses by automating tasks such as bookkeeping, invoicing, time tracking, sales tax management, budgeting, bank reconciliation and inventory tracking.

Intuit’s new feature, Intuit Assist, powered by generative AI, is an AI-enhanced financial assistant that provides intelligent insights and personalized data-backed recommendations to help you make informed financial decisions and optimize your business operations.

Pros and Cons

| Pros | Cons |

|---|---|

| Feature-rich and extensive integration option | Expensive |

| Easy to set up and use | To get affordable prices, you’ll need to forfeit your free trial |

Pricing

A 30-day free trial is available.

- Simple Start: The actual price is $30 per month, currently being sold at a 50% discount for three months.

- Essentials: The actual price is $60 per month, currently on sale at a 50% discount for three months.

- Plus: The actual price is $90 per month, currently being sold at a 50% discount for three months.

- Advanced: The actual price is $200 per month, currently being sold at a 50% discount for three months.

Features

- Track money in — track income, accept payments, invoicing, estimates, and business bank accounts.

- Track money out — expenses, sales tax and pay contractors.

- Tax preparation and filing.

- Reports and insights — project profitability reports and tag transactions.

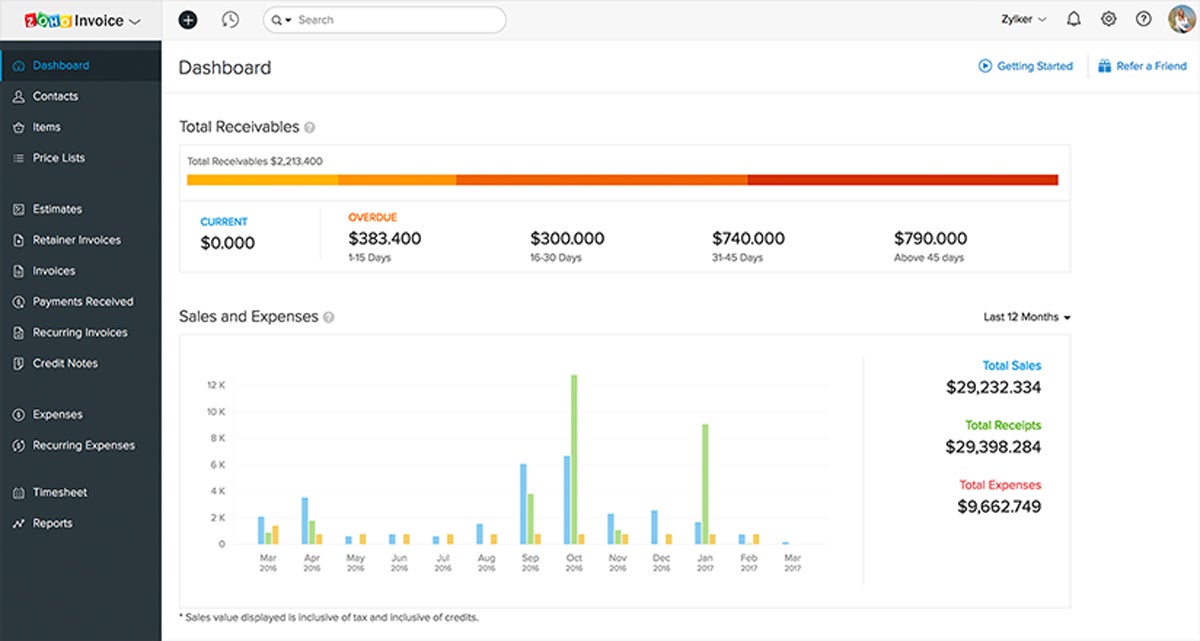

Zoho Finance Plus: Best for Service-Based Businesses

Overall Rating: 3.7

- Pricing: 2.3

- Feature Set: 4.1

- Ease of Use: 3.5

- Support: 3.5

Zoho Finance Plus combines the functionalities of various Zoho products such as Zoho Invoice, Zoho Books, Zoho Checkout, Zoho Expense, Zoho Inventory, and Zoho Billing into a single platform. This integrated solution is tightly connected with Zoho CRM, providing a unified experience for managing contact interactions, sales and purchase orders, inventory management, expenses, subscriptions, accounting, online payments, and tax compliance.

Zoho Finance Plus is an ideal solution for a variety of businesses, especially for service-based companies such as consulting firms, agencies, freelancers, and professional services providers. The platform caters to businesses that require financial management tools to facilitate operations, manage invoices, track expenses, handle subscriptions, and ensure tax compliance. Our analysis found that Zoho’s ability to handle subscriptions and recurring payments is particularly useful for service-based businesses with subscription models.

Pros and Cons

| Pros | Cons |

|---|---|

| Tight integration with various Zoho apps | Zoho Books functionalities can be better |

| Feature-rich and modern interface | Limited customization |

Pricing

A 14-day free trial is available.

- $249 per organization per month — includes 10 users.

- $199 per organization per month, billed annually — includes 10 users.

Features

- Zoho Books capabilities which include profit and loss (P&L) reports, balance sheets, tax reports, bills, expenses, general ledger, and vendor credits.

- E-commerce integrations.

- One time and recurring billing.

- Subscription metrics – MRR (monthly recurring revenue), ARPU/A (Average revenue per user/account) and LTV (Lifetime value).

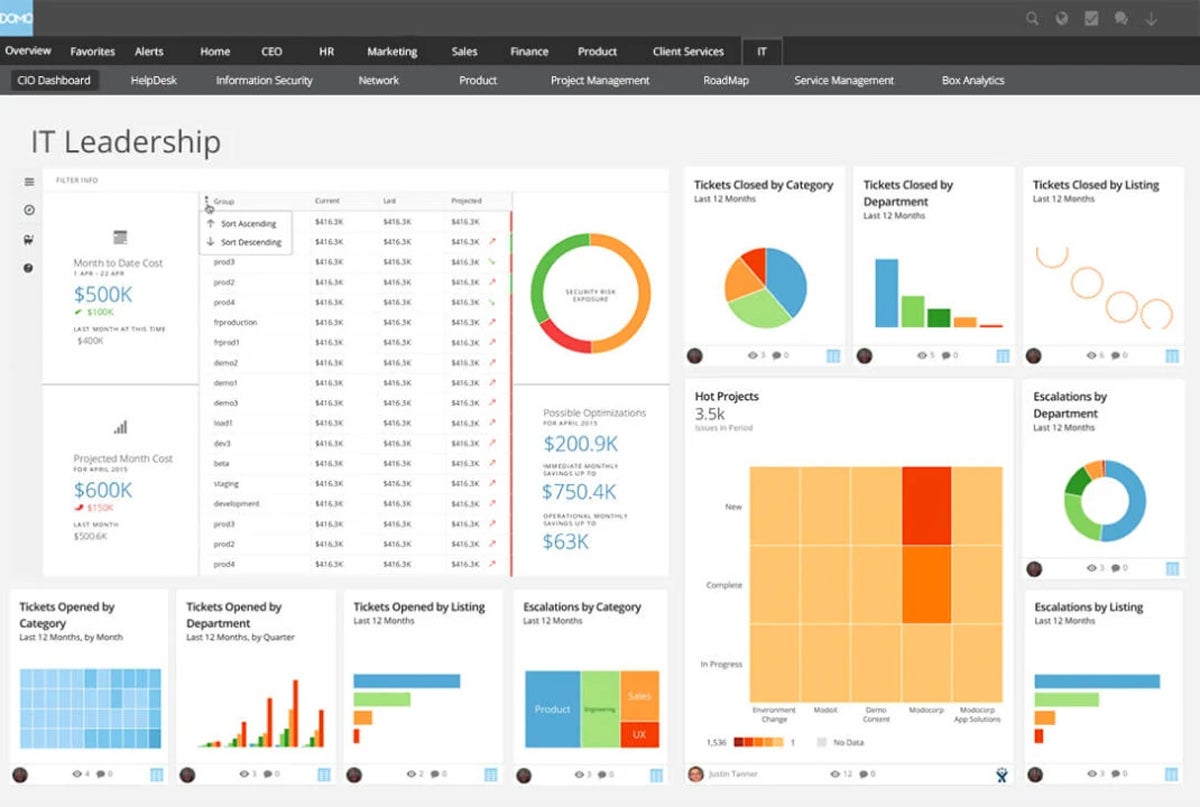

Domo: Best for Business Intelligence and Analytics

Overall Rating: 3.7

- Pricing: 1.2

- Feature Set: 5

- Ease of Use: 3.5

- Support: 5

Domo is a cloud-based data experience and integration platform that enables organizations to leverage their data for decision-making. By providing a unified dashboard that consolidates data from various sources, Domo empowers businesses to gain valuable insights and drive strategic actions based on real-time information.

Domo’s platform enables finance professionals to access information to support financial planning, budgeting, forecasting, and reporting. Our evaluation found that you can connect Domo with 203 finance apps, including NetSuite, QuickBooks, Sage Intacct, Xero, and FreshBooks.

By leveraging AI algorithms, Domo can analyze vast amounts of financial data, identify trends, anomalies, and potential risks, and provide actionable recommendations. This empowers finance professionals to drive strategic decision-making, optimize financial processes, and improve overall business performance.

Pros and Cons

| Pros | Cons |

|---|---|

| Generous free plan | Steep learning curve |

| Fast and responsive support | Costly for small businesses and startups |

Pricing

- Free: No cost for up to 300 credits per month.

- Standard:

- $300 per month for up to 300 credits.

- $600 per month for up to 500 credits.

- $900 per month for up to 600 credits.

- $1,200 per month for up to 700 credits.

- Enterprise: Custom quote.

- Business Critical: Custom quote.

Features

- Dashboard interactivity and customization.

- Business app creation.

- Business intelligence and analytics.

- Data integration from any source.

Booke.AI: Best for Bookkeeping Automation

Overall Rating: 3.00

- Pricing: 2.1

- Feature Set: 4.1

- Ease of Use: 3.5

- Support: 1

Booke leverages AI to automate bookkeeping tasks, streamline data extraction from documents like invoices and bills, and improve client communication. It helps fix uncategorized transactions and coding errors and improves client communication. Booke.AI uses real-time optical character recognition (OCR) AI to extract data from invoices, bills, and receipts, accelerating transaction processing and saving time.

Booke has a Robotic AI Bookkeeper tool that integrates with QuickBooks Online (QBO) to review bank feeds and correctly categorize transactions. It utilizes AI models trained on historical business data to automate transaction coding to the correct general ledger accounts.

Pros and cons

| Pros | Cons |

|---|---|

| Automated GPT-4 driven transaction categorization | Limited support channels |

| The AI continuously learns and improves its categorization abilities based on user feedback | No free trial |

Pricing

- Data Entry Automation Hub: $20 per business per month or $18 per business per month, billed annually.

- Robotic AI Bookkeeper: $50 per business per month or $45 per business per month, billed annually.

Features

- OCR AI — automated invoices, bills and receipts processing.

- Handles daily, weekly, and monthly bookkeeping with GPT-driven robotic process automation (RPA).

- Browser extension for Xero and QBO: Directly ask clients in QBO and perform bulk reconciliation in Xero.

- Month-end close audit.

- Reconciliation AI-assistant.

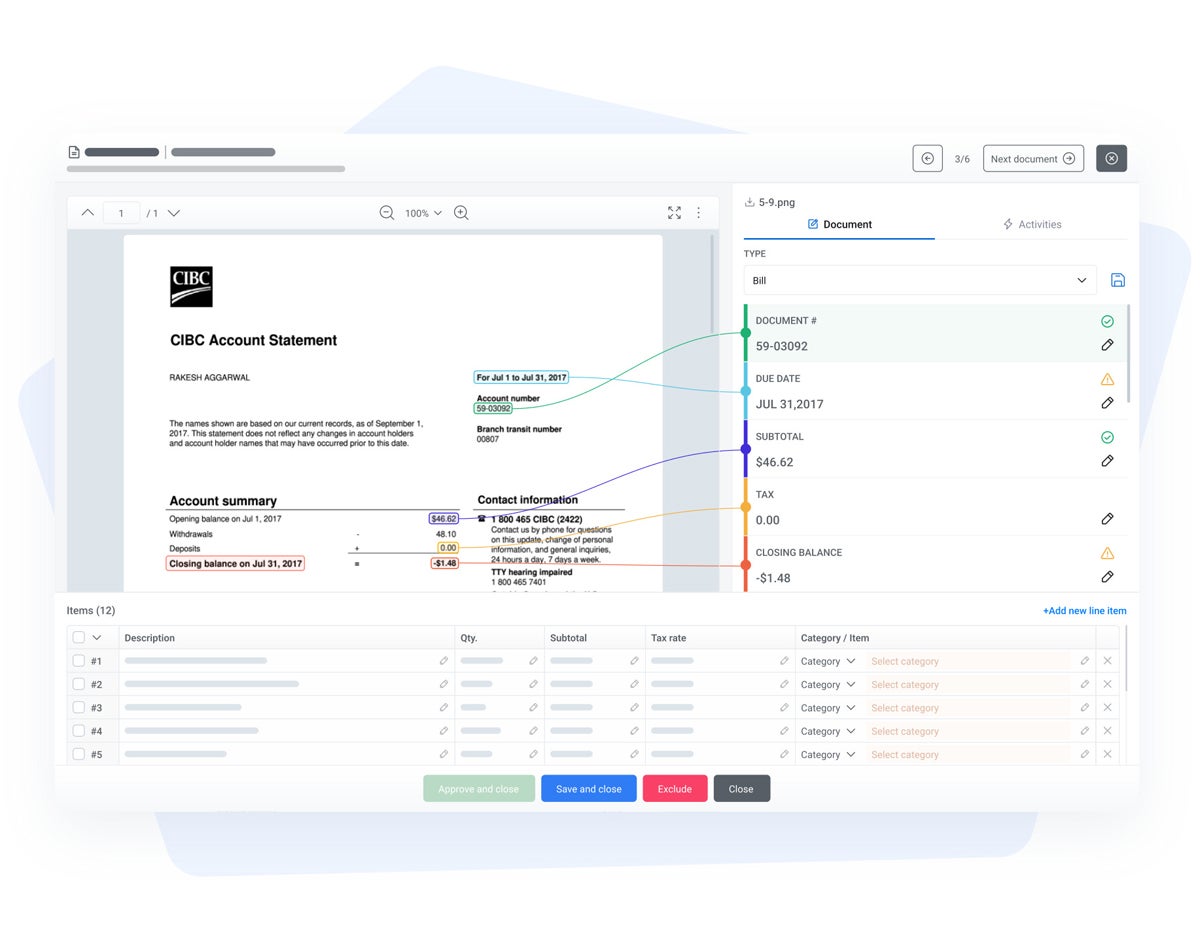

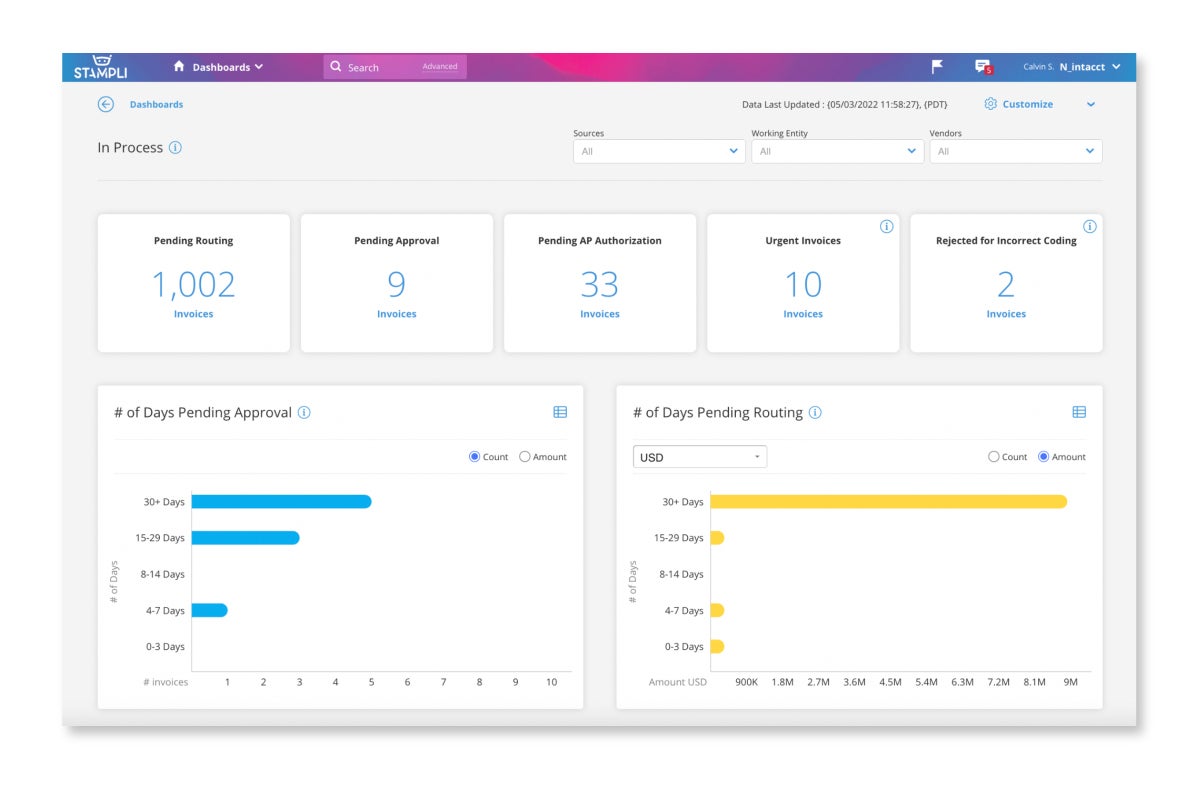

Stampli: Best for Accounts Payable Teams

Overall Rating: 2.7

- Pricing: 0

- Feature Set: 4.1

- Ease of Use: 3.5

- Support: 3

Stampli is an accounts payable (AP) automation platform that helps businesses simplify their invoice processing and payment workflows. It uses AI-driven technology to automate data extraction, invoice approvals, and payment processing, helping organizations save time and eliminate manual data entry errors. Stampli also provides analytics and reporting tools to help businesses gain insights into their accounts payable processes. It centralizes AP-related communication, documentation, and workflows into one platform, making it easier for finance teams to manage and control their AP processes.

Stampli’s accounts payable AI, Billy the Bot, automates manual tasks such as coding invoices, detecting duplicates, matching discrepancies, and routing approvals based on company policies.

Pros and Cons

| Pros | Cons |

|---|---|

| Centralized collaboration | Lacks transparent pricing |

| AI-enhanced insights | Some users reported issues with the approval process |

Pricing

Contact the company for a personalized quote.

Features

- It integrates with 70+ ERP apps including Sage, SAP, Oracle NetSuite and more.

- Automate invoice capture, coding and approvals.

- Purchase orders (PO) — 2- and 3-way PO match, process partial amounts, update line items and add new ones directly in Stampli.

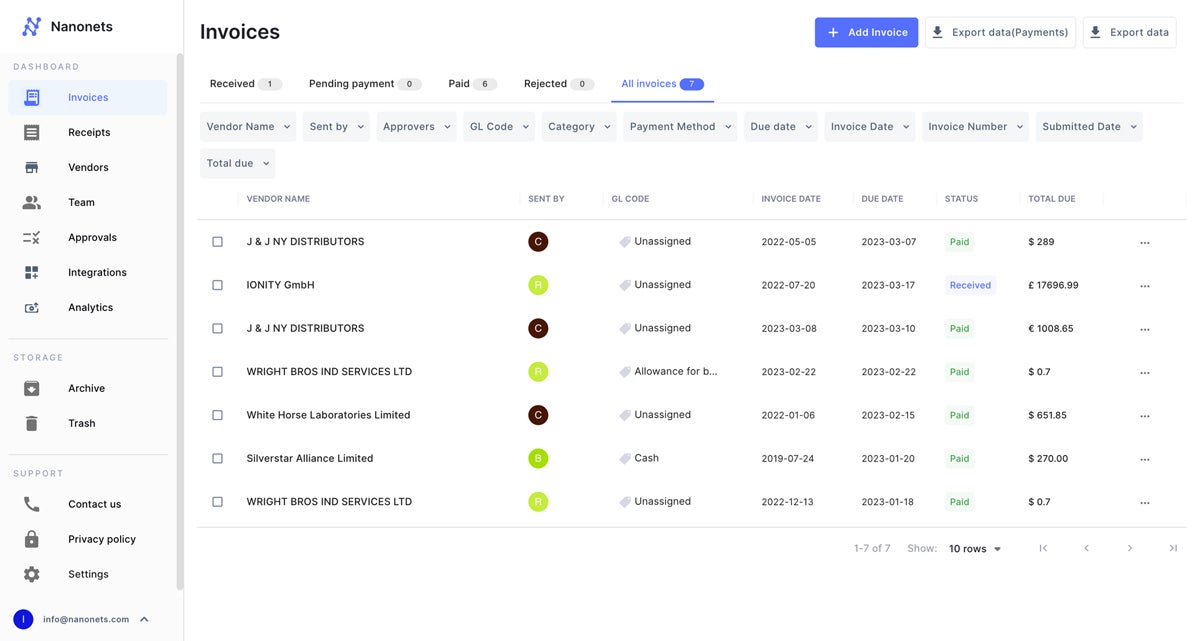

Nanonets: Best for Automated Data Capture

Overall Rating: 3.5

- Pricing: 1.2

- Feature Set: 4.3

- Ease of Use: 4

- Support: 5

Flow by Nanonets is an end-to-end to AI-based AP automation software designed to help finance teams manage supplier communication, process invoices, and optimize the accounts payable process. With Flow, you can facilitate invoice processing, provide visibility into spending, and ensure compliance with automated approval workflows and controls.

The software uses OCR technology to automatically read and capture invoice details from emailed or scanned invoices, eliminating the need for manual data entry.

Flow integration with existing accounting software syncs captured invoice information, including line items and GL codes in real-time, ensuring that all financial data is accurately reflected across systems for financial reporting.

Pros and Cons

| Pros | Cons |

|---|---|

| Support up to 300+ document types | Initial learning curve |

| Set up custom accounts payable approval policies | Starter and Pro plans have limited functionalities |

Pricing

- Starter: Pay-as-you-go, first 500 pages free, then $0.3 per page.

- Pro: $999 per month per model for 10,000 pages, then $0.1/page.

- Enterprise: Custom quote.

Features

- It integrates with QuickBooks, Stripe, and Slack.

- Extracted data validation.

- Support on-premises deployment.

- Collect historical data across SAP, Square, and Tableau.

- Customizable Document data extraction.

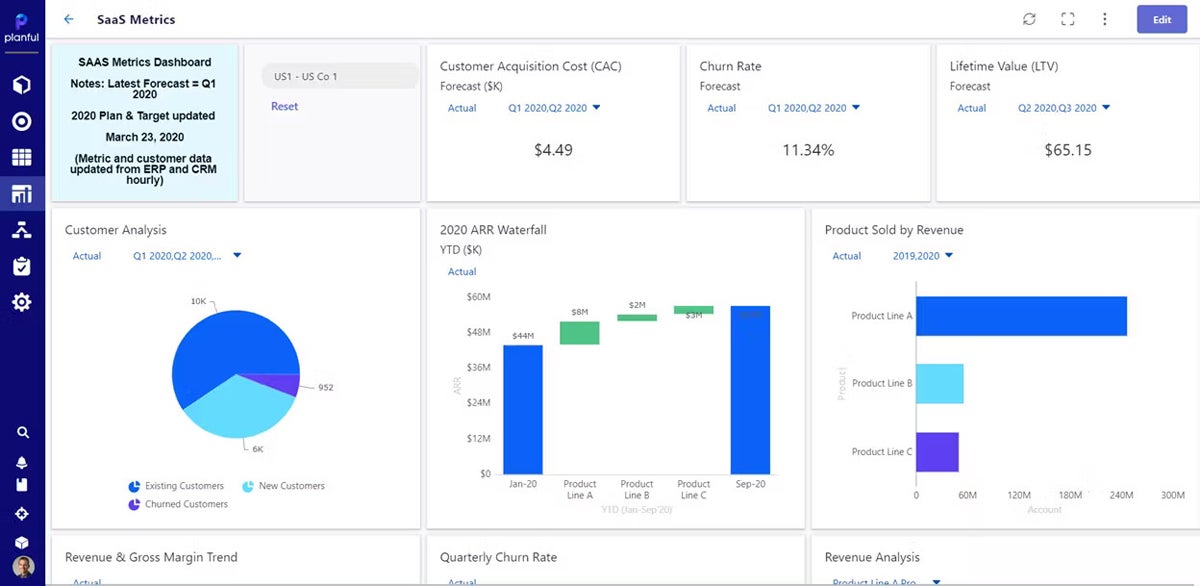

Planful: Best for Financial Planning and Analysis

Overall Rating: 3.3

- Pricing: 1

- Feature Set: 5

- Ease of Use: 3.5

- Support: 5

Planful is a cloud-based financial planning and analysis platform that helps organizations streamline their budgeting, forecasting, and reporting processes. It offers advanced features such as scenario planning, financial modeling, and real-time data integration to help businesses achieve financial agility.

Its Planful Predict tool incorporates AI-powered capabilities to enhance financial decision-making by automating tasks, reducing errors, and providing intelligent insights for forecasting and anomaly detection. Planful Predict is integrated within the Planful platform and includes two components – Predict: Signals for anomaly detection; and Predict: Projections for financial forecasting. With these tools, users can automate tasks, improve data integrity, and receive intelligent recommendations to enhance their financial planning processes.

The solution is designed for CFOs, CEOs and other business leaders looking to optimize their financial planning processes.

Pros and Cons

| Pros | Cons |

|---|---|

| Easy to use | Lacks pricing transparency |

| Adaptable/customizable for unique use-cases that business requires | The user interface can use some upgrades |

Pricing

Contact the company for a custom quote.

Features

- Budgeting and forecasting.

- AI-powered insight.

- Reporting and analytics.

- Scenario analysis.

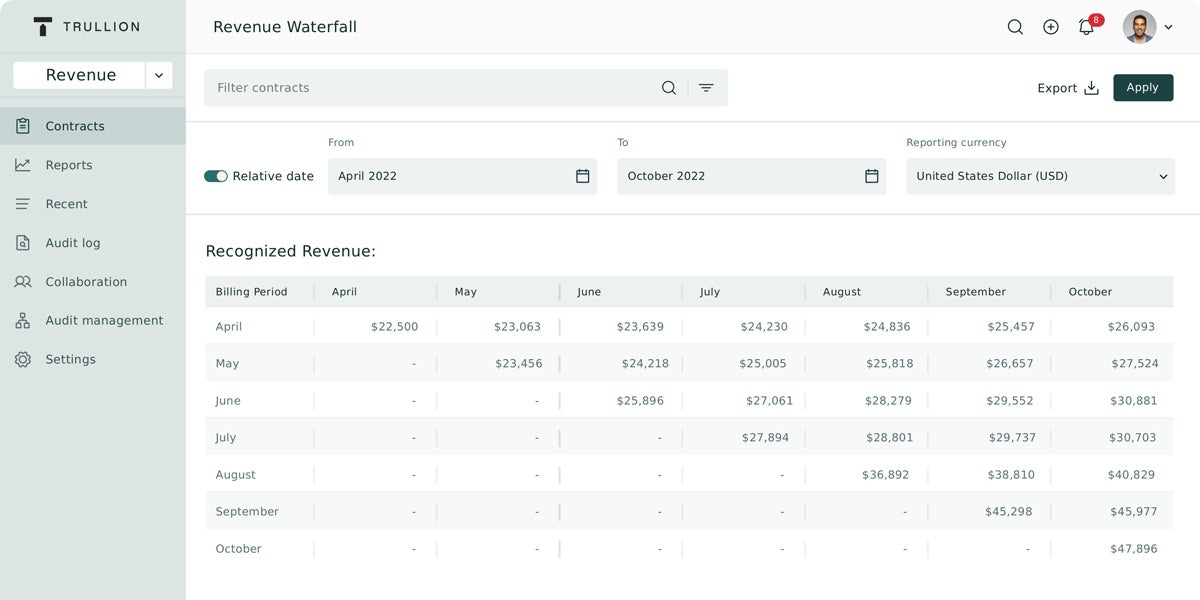

Trullion: Best for Companies with Complex Financial Transactions

Overall Rating: 2.7

- Pricing: 0

- Feature Set: 4.3

- Ease of Use: 3.5

- Support: 2

Trullion leverages AI to simplify the audit process, eliminate manual data entry, and provide real-time insights to help businesses make better financial decisions. They offer automated data extraction, risk assessment, compliance monitoring, and report generation services to help companies stay compliant with regulations and improve their financial operations.

Trullion offers solutions for revenue recognition, audits, and lease accounting. Using AI, the revenue recognition system allows users to generate reports, identify discrepancies, and ensure compliance with regulatory requirements. This is achieved by extracting data from various information systems such as billing, CRM, contracts, and Excel workbooks and validating it all on the Trullion platform.

The audit solution provided by Trullion allows the execution of audits for multiple clients using automated and intelligent workflows. The platform enables collaboration between auditors and accounting teams, which can help to reduce the duration and cost of audits. Trullion’s lease accounting solution enables the automation of complex lease accounting workflow. It extracts both structured and unstructured data from lease contracts and Excel workbooks, automates compliance and reporting, and allows the management of complicated modifications in one place.

Pros and Cons

| Pros | Cons |

|---|---|

| Encourages collaboration | Lacks pricing transparency |

| Reduces the risk of errors. | Lease accounting functionality can be improved |

Pricing

Contact the company for a custom quote.

Features

- Revenue recognition.

- Audit capability.

- It integrates with CRM, data warehouse, and ERP solutions.

- Lease accounting functionality.

- Data automation.

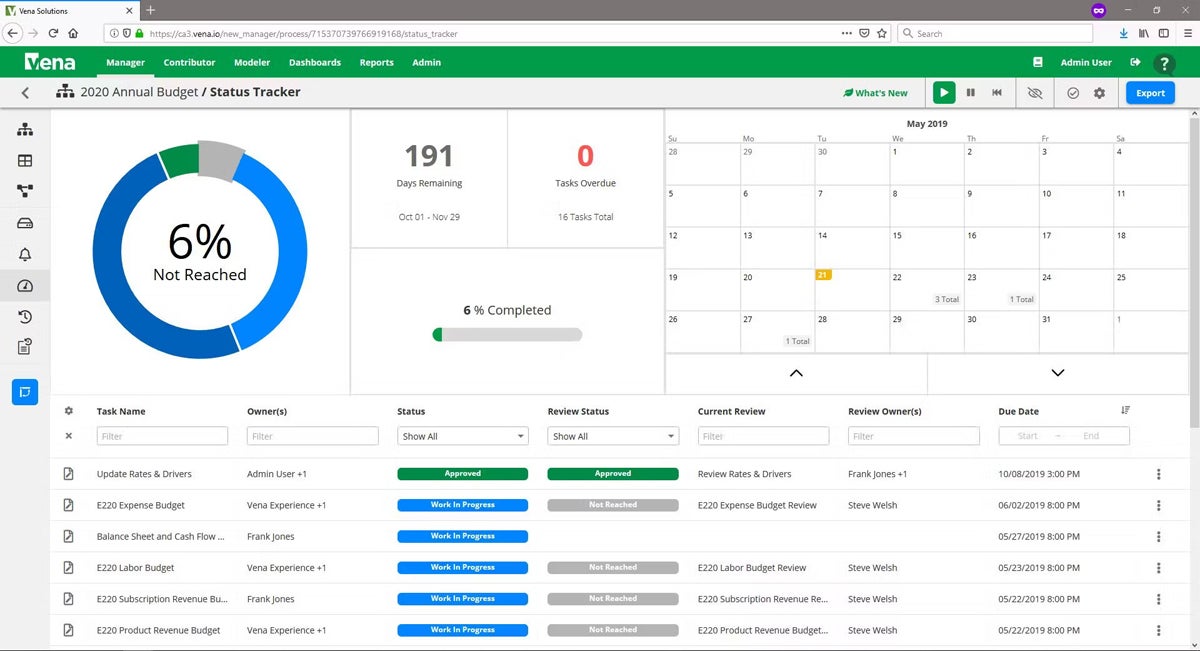

Vena: Best for Real-time Intelligent Reporting and Analysis

Overall Rating: 3.1

- Pricing: 1

- Feature Set: 4.3

- Ease of Use: 3.5

- Support: 5

Like Planful, Vena is also a financial planning and analysis software designed for budgeting, planning, forecasting, and consolidation. Vena stands out as an excellent choice for real-time intelligent reporting and data analysis. Its integration with Microsoft 365 allows users to leverage tools like Excel, Power BI, and PowerPoint for in-depth data analysis and robust reporting capabilities.

On Vena, you can easily create budgets, models, and scenarios, as well as collaborate with team members through shared workspaces and workflows. Vena also offers a centralized data repository and automated data collection, reducing manual errors and ensuring data accuracy.

Pros and Cons

| Pros | Cons |

|---|---|

| The Excel interface makes it appealing to individuals familiar with Excel workings | May be somewhat complex for those unfamiliar with Excel |

| Fast and responsive customer support | Limited online learning resources |

Pricing

Contact the company for a custom quote.

Features

- Reporting and analytics.

- Full Microsoft Excel integration.

- Central database — includes both relational/online transaction processing (OLTP) and an in-memory online analytical processing (OLAP) database.

- Budgeting and forecasting.

- CapEx planning.

- Revenue, scenario, cash flow and workforce planning.

How to Choose the Best AI Finance Software for Your Business

Given the sensitive nature of financial data, it’s essential to employ a strict methodology when selecting an AI finance tool. Whether you want to automate accounting processes, predict financial trends, or enhance fraud detection, you must invest time and resources in choosing the right software for your business.

Here is a checklist to use for your selection:

- Determine your use case.

- Evaluate the features.

- Check for compatibility with your existing systems — ERP, CRM, and other financial management tools.

- Consider security measures.

- Be aware of scalability issues; can the solution grow with your business?

- Budget considerations.

Though we have done the research work for you and analyzed the best AI finance software based on 13 data points across four categories, you should take the time to identify the problem you want the tool to solve and the specific features you need before making a decision.

How We Evaluated the Best AI Finance Software

We analyzed the best AI finance software and tools based on 13 key data points across four categories to help you find the best software for your business.

Cost – 25%

The cost of each tool was evaluated based on factors such as the overall affordability of the software, transparency of pricing, and the availability of a free trial. Note about low scores for pricing: in a few instances, because a vendor lacks transparency for pricing, it received a low score in the Cost category.

Feature Set – 35%

Feature set carries the highest weight in our evaluation as it directly impacts the capabilities and functionality of the software. We looked at factors such as the extent of AI use in solutions, customization options, integration with other tools, and advanced security features. We also checked to determine if the solution is advanced enough for business users to leverage for their financial service needs.

Ease of Use – 25%

Ease of use was evaluated based on the software’s user interface, navigation, and overall user experience. Factors such as accessibility and intuitiveness were considered in determining the ease of use of each tool.

Support – 15%

Support was evaluated based on the availability of customer support channels, response times, and overall customer satisfaction ratings. We considered factors such as live chat support, phone support, and comprehensive knowledge base resources to determine the level of support provided by each AI finance software vendor.

Frequently Asked Questions (FAQs) About AI Finance Software

We answered some commonly asked questions about AI finance tools to help you discover the ideal software for your business.

What is the best AI finance tool?

The best AI finance software will vary depending on your specific business needs and goals. It is important to research each option thoroughly and consider factors such as pricing, user reviews, and features to determine the best fit for your business.

How AI can assist in financial services

Some common applications of AI in finance include:

- Credit scoring.

- Fraud detection.

- Algorithmic trading.

- Portfolio management.

- Risk assessment.

- Customer service.

What are the benefits of AI finance software?

- Improved accuracy in financial reporting and forecasting.

- Increased efficiency in data processing and analysis.

- Reduced risk of errors or fraud.

- Better insights into financial trends and opportunities.

- Automated tasks such as invoicing, bill payments, and budgeting.

Bottom Line: The Best AI Finance Tools

Financial management has evolved from traditional repetitive tasks and manual data entry methods into AI-charged software that can automate processes, provide real-time insights, and help businesses make more educated decisions.

AI finance tools not only make your finance teams more agile but also reduce errors and allow them to focus on more strategic tasks. This saves you money and keeps your teams more productive. The benefits of AI finance tools are clear and the return on investment (ROI) can be substantial in the long run.

For a full portrait of the AI vendors serving a wide array of business needs, read our in-depth guide: 150+ Top AI Companies 2024